Charts @ Global

I look at hundreds of charts a day. I will be sharing Global charts , tables , news on sector , stock , economy. Subscribe to get Global Charts in your inbox on weekdays at 5 am IST.

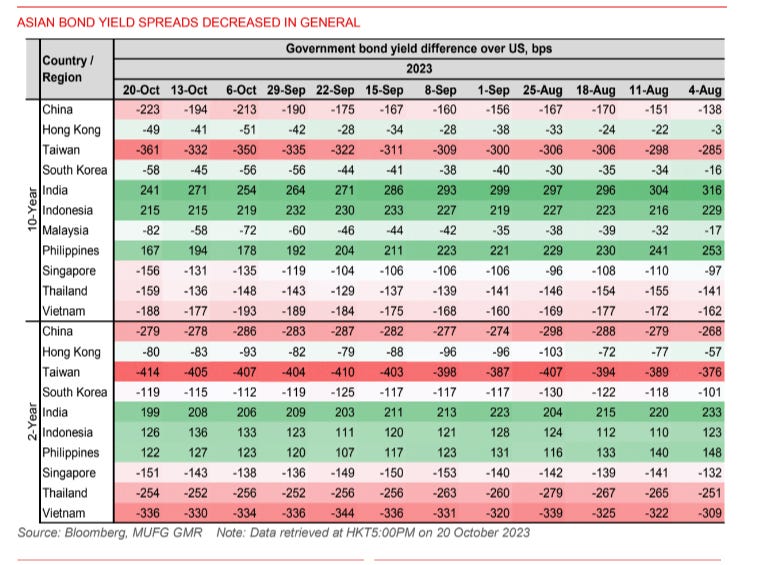

MUFG || Government bond yield spread : decreases in general

For longer-end,most #Asian economies’ 10-year government bond yield spread with US declined amid the background of 32bp increase inUS 10-year Treasury yield,with #India(-30bps) leading, followed by #China(-29bps),#Taiwan (-28bps),Philippines(-27bps), Malaysia (-25bps), #Singapore (-25bps), #Thailand (-23bps), South Korea (-13bps), #Vietnam (-12bps)and Hong Kong(-8bps). For shorter-end,decreases in 2-year #government #bond #yield spreads with #US were foremost Asian economies, except for China and #Hong Kong.

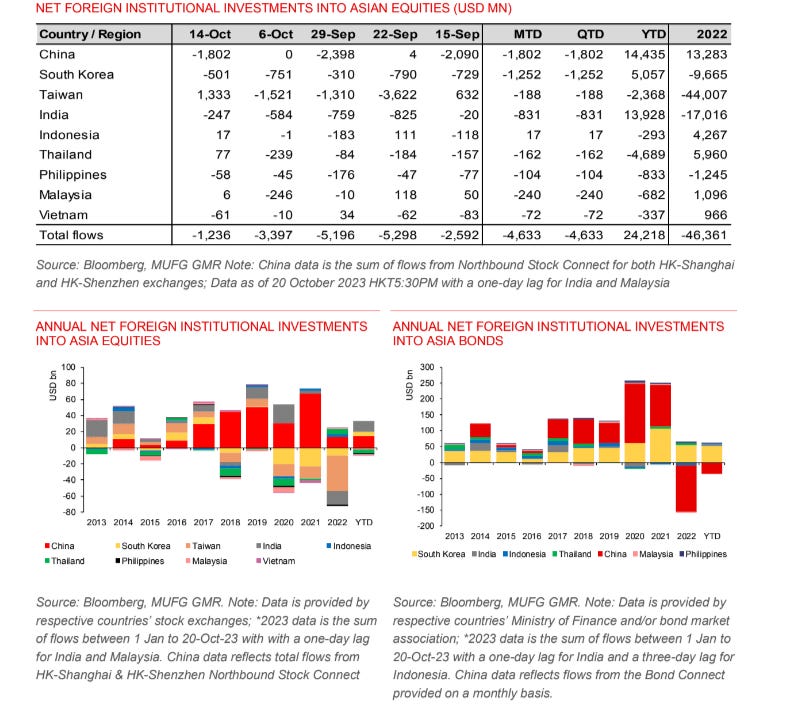

MUFG || FOREIGN OUTFLOWS FROM ASIA-EX-JAPAN’S EQUITY MARKETS AMIDST STRONGER US DOLLAR AND GEOPOLITICAL UNCERTAINTY

Asian equity markets saw net outflows of US$1.2bn during the week,on the back of the US$3.4bn outflows the previous week.The selling was led by China, whichhad outflows of US$1.8bn, followed by South Korea, with US$501mn of equity outflows.Interestingly, Taiwan saw inflows of US$1.3bn, and this partly came on the back of better exports data.Meanwhile, India’s equity markets has been experiencing outflows over the past 6 weeks, following a year of strong foreign equity inflows thus far or close to US$14bn.

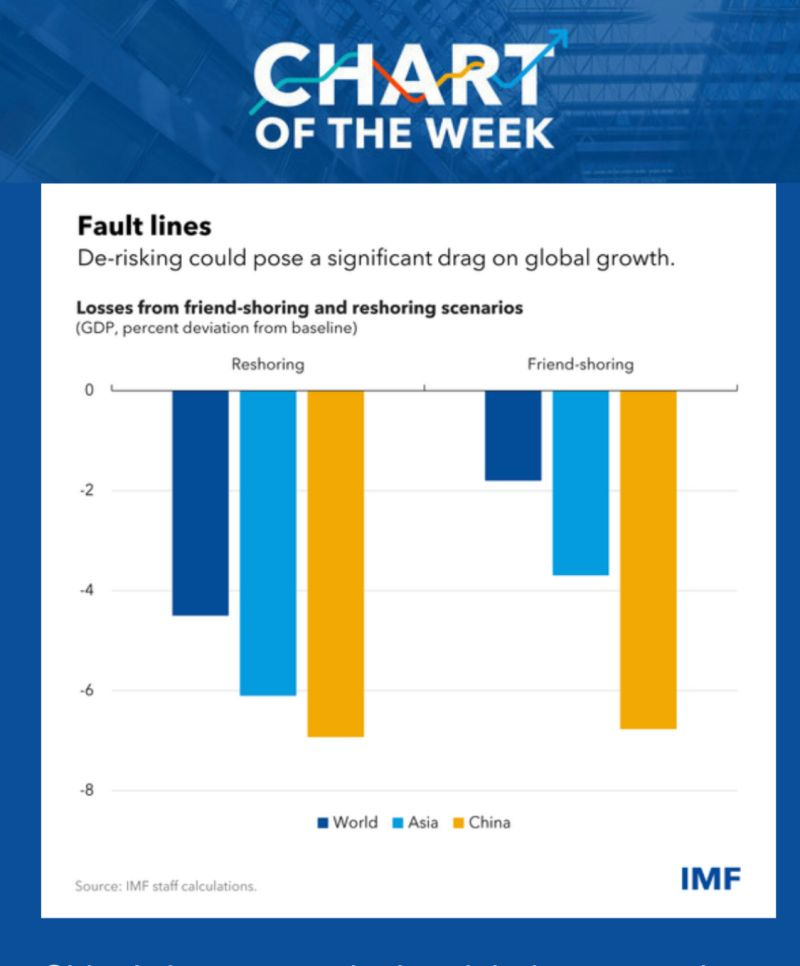

From the IMF:

“As the Chart of the Week shows, so-called “de-risking strategies” by China and the United States and other OECD countries that aim to reshore production or friend-shore away from one another can result in a significant drag on growth—especially in Asia.”

This forecast will not deter countries from “de-risking.” Indeed, it is one of the four main factors that call for policymakers and businesses to prepare more seriously for a multi-year period of an insufficiently-flexible and more inflation-prone global supply side.

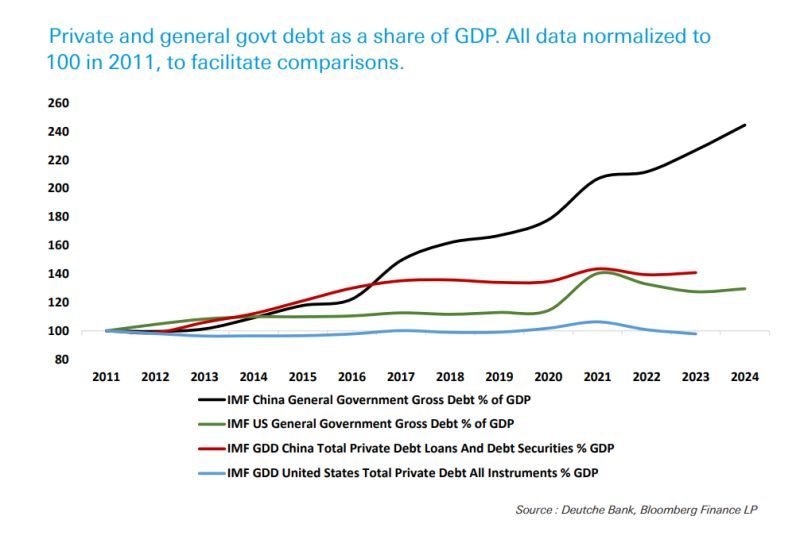

If US debt is high, China is a debt hole ...