Hello Everyone

I look at hundreds of charts a day. I will be sharing Global charts , tables , news on sector , stock , economy. Subscribe to get Global Charts in your inbox on weekdays at 5 am IST.

The yield curve spread that most accurately forecasts recessions is that between the 10-year Treasury bond yield and the 3-month Treasury bill rate. Figure Two depicts the US bond yield, bill yield, and yield-curve spread since 1968. Negative spreads preceded all recessions, regardless of whether yields generally were high or low, and regardless of whether inversion resulted from short-term (bill) yields rising above long-term (bond) yields (due mainly to Fed rate hiking) or instead (and less frequently) from bond yields declining below bill yields.

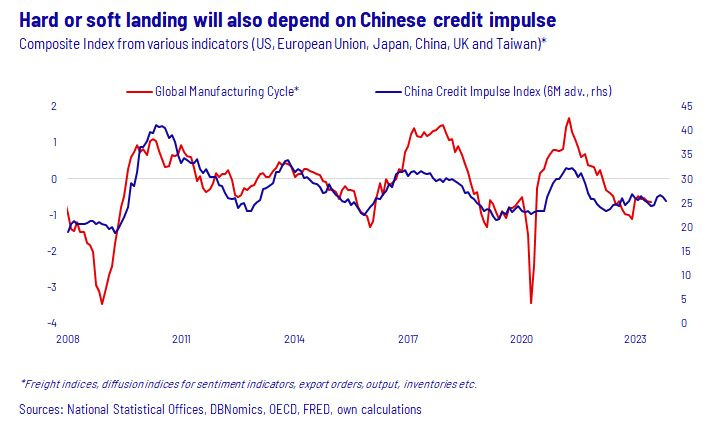

Talk about hard or soft landing of global #economy seems entirely focused on central banks. But from a liquidity standpoint, #China's credit impulse will also be a major factor. Watch #credit expansion of local governments over the next few months. It could turn the needle one way or the other. Currently no clear direction

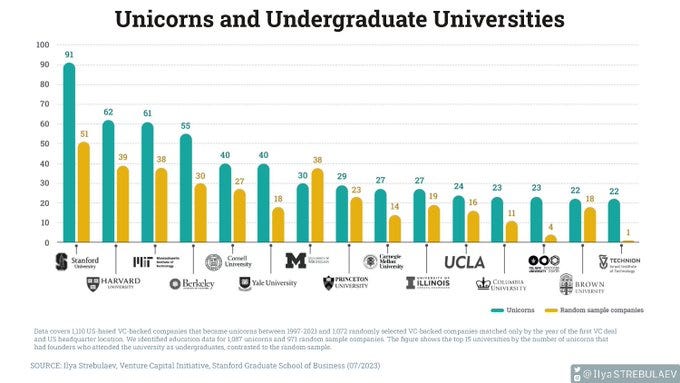

Which undergraduate programs are more likely to “produce” unicorns?

@Stanford

leads the way with 91 unicorns having founders who attended their undergraduate program. However,

@TechnionLive

has the highest ratio of unicorns per random company

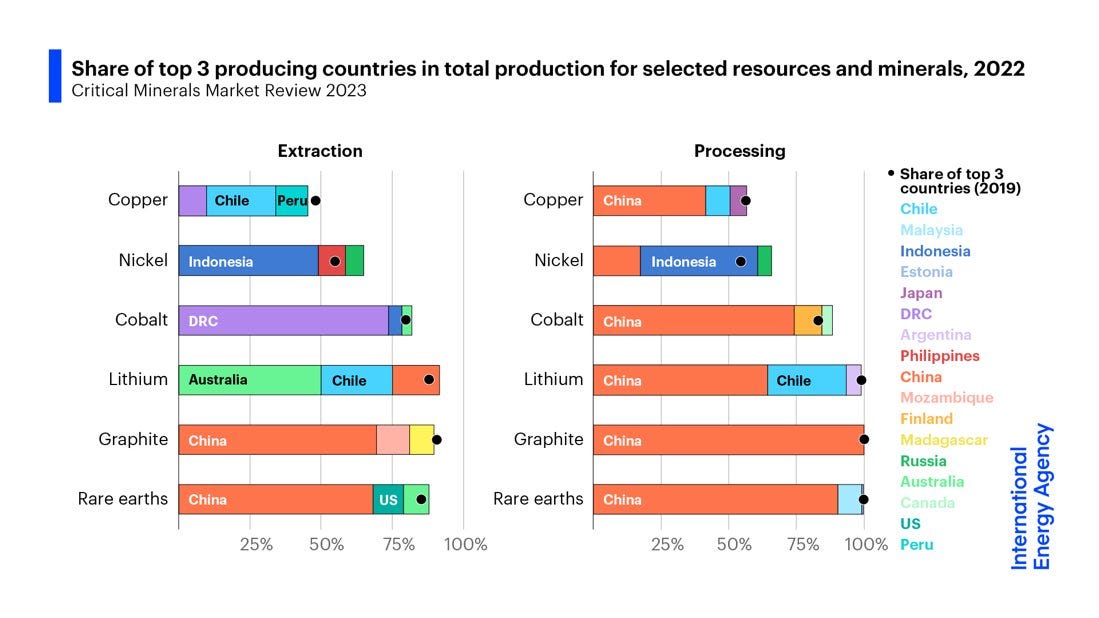

IEA released their critical minerals market report. Obviously exposes risk due to supply diversification China has most processing capabilities than rest of the world put together 75% of Cobalt production from DRC & >50% rare earth from China

AI could power the next productivity boom -BofA

Bonus Report

KEY MESSAGES

US consumers have spent at an above-trend pace over the last couple years by leaning on excess savings built up over the course of the pandemic.

This dynamic is fading – and looks set to end soon, with excess household savings likely to be depleted by year-end.

Distributional data suggest both excess savings and cash balances skew toward the top income earners, and are already depleted for most US households.

Absent this cushion, we expect US consumers to become increasingly sensitive to labor market dynamics.

Our base-case forecast for rising unemployment should translate to slower spending growth and higher consumer delinquency rates.